Home

>

Resources

Explore S3 Ventures portfolio of investments and career opportunities in this in-depth guide

Table of Contents

Add a header to begin generating the table of contents

S3 Ventures Overview

S3 Ventures, based in Austin, TX, has been a key player in the Texas venture capital scene for over 17 years.

Established in 2005 by Brian R. Smith, the firm supports visionary founders by offering patient capital and crucial resources needed to build exceptional, high-impact companies in the sectors of Business Technology, Digital Experiences, and Healthcare Technology.

The firm specializes in leading Seed, Series A, and Series B investments, typically ranging from $500K to $10M, and has the ability to invest $20M+ throughout the lifecycle of a company. In addition, their sole limited partner can participate in later-stage growth rounds for portfolio companies.

Since inception, S3 Ventures has been supported by a philanthropic family with a multi-billion-dollar foundation. This unique sole-LP structure allows the firm to stay focused on supporting founders without the typical fundraising distractions and constraints faced by traditional venture capital firms.

S3 Ventures AUM

According to the official site of S3 Ventures, the firm has over $900 million in assets under management.

S3 Ventures Interview Process & Questions

While firms can adjust their interview processes for each candidate, if you are interviewing at S3 Ventures or a similar firm, you can generally expect the following:

- Approximately 4-6 interview rounds

- Initial interviews typically led by junior investment professionals or the HR team, with senior staff conducting later rounds

- The entire process usually spans several weeks, unless it is part of “on-cycle” or “on-campus” recruiting

The interview process at S3 Ventures will likely include a combination of fit questions, behavioral questions, and technical/investing questions.

If you need assistance in preparing for interviews, consider checking out my Growth Equity Interview Guide.

Why S3 Ventures

One of the most frequent and crucial interview questions you may encounter is, “Why this firm?”

If you have networked with people at the firm, this is an excellent opportunity to mention those connections and the positive impressions they left on you.

Also, thoroughly researching the firm before your interview is definitely important. An effective way to learn about the firm is by listening to interviews with its founders or key investors.

For starters, here’s an interview with Brian Smith, Founder & Managing Director of S3 Ventures:

More Interview

S3 Ventures Case Study

Interview candidates typically encounter a case study during the interview process. Case studies allow firms to evaluate your technical expertise and communication skills.

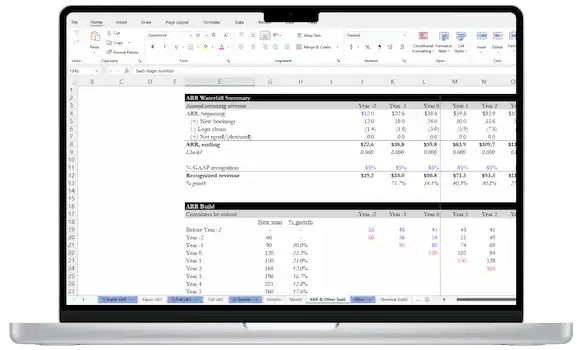

At firms like S3 Ventures, case studies often center on financial modeling and investment recommendations. For junior positions, there is frequently a cold calling case study included as well.

If you need help preparing for case studies, consider using my Growth Equity Interview Guide.

S3 Ventures Salary & Compensation

According to Salary.com, the average base pay for Investment Associates is $78K per year, and the average salary at the firm ranges from $75,388 to $97,393 per year. There is no recent salary data for analyst hires.

Associate

S3 Ventures Careers, Jobs, & Internships

To see open roles at S3 Ventures, check out our job board which features all open roles for them and other similar firms.

S3 Ventures Portfolio & Investments

According to Crunchbase, S3 Ventures has made 101 investments across six funds. Some of their notable deals include Hydrolix, Arpio, and Riscosity.

Notable Transaction: CereTax

CereTax, a next-generation sales tax automation solution, announced on June 25, 2024, that it has secured $9 million in financing. The funding round was led by S3 Ventures, with participation from Wild Basin Investments and Leaders Fund.

CereTax processes millions of transactions per month for some of the largest enterprises, helping businesses operate reliably and in compliance.

Aaron Perman, Partner at S3 Ventures, highlighted the challenges enterprises face with sales and use tax determination and compliance, emphasizing the limitations and errors of legacy solutions. He expressed enthusiasm for partnering with CereTax, noting their groundbreaking work in developing the first new enterprise SaaS platform for indirect tax in two decades.

With the new funding, CereTax plans to enhance product innovation and support for customers and partners. The company also announced key hires to help scale the business: Dario Salas Machado as Vice President of Finance and Marni Burger as Vice President of Marketing, both bringing over 15 years of expertise in their respective fields.

Next Steps

If you’re aiming to join the team of professional investors at S3 Ventures, I strongly suggest exploring my Growth Equity Interview Guide.

This self-paced online course is designed for professionals looking to enter the growth equity field, helping to boost their chances of landing their target role. It covers essential interview topics like case studies, financial modeling, and more.

Start getting ready for your interviews today!

- More Guides

▸ Break Into Growth Equity

▸ Break Into Venture Capital

▸ 🚀 Break Into Private Equity

▸ Break Into Investment Banking

▸ 📗 Primer: Growth Equity

▸ 📗 Primer: Private Equity

▸ 📗 Primer: Investment Banking

DIVE DEEPER

The #1 Online Course for Growth Investing Interviews

- 63 lessons

- 13h video

- Templates

- Step-by-step video lessons

- Self-paced with immediate access

- Case studies with Excel examples

- Taught by industry expert

Learn More

Get My Best Tips on Growth Equity Recruiting

Just great content, no spam ever, unsubscribe at any time